trust capital gains tax rate 2019

In other words if you are falling in 28 tax bracket short term capital gains in your hand will be will be taxed 28. Income and short-term capital gain generated by an irrevocable trust gets taxed at high rates.

Extends The Due Date For Filing Of Income Tax Returns From 31st July 2019 To 31st August 2019 Income Tax Return Tax Return Income Tax

The tax-free allowance for trusts is.

. If the estate or trust receives its income unevenly throughout the year it may be able to lower or eliminate the. Below are the tax rates and income brackets that would apply to estates and trusts that were opened for deaths that occurred in 2021. USA State and Local Taxes.

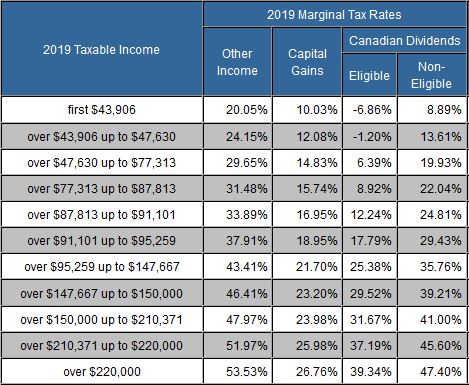

An individual would have to make over 518500 in taxable income to be taxed at 37. Short-term capital gains from assets held 12 months or less and non-qualified dividends are taxed as ordinary income. However long term capital gain generated by a trust still maxes out at 20 plus the 38 when taxable trust income exceeds 13050.

Complex trusts with the same amount of interest. For tax year 2019 the tax brackets are 10 24 35 and 37 which are different from the 2018 brackets 15 24 28 33 and 396. 2020 Tax Rates Thresholds and Allowance for Individuals Companies Trusts and Small Business Corporations SBC in South Africa.

For example if a trust has taxable income of 13000 in 2019 and then subsequently makes a distribution of 13000 to a. Capital Gain Qualified Dividend Rates. Trustees only have to pay Capital Gains Tax if the total taxable gain is above the trusts tax-free allowance called the Annual Exempt Amount.

In contrast married couples filing jointly are subject to the 37 tax bracket at income levels of 622051. A net capital gain for the current year of assessment is multiplied by the inclusion rate applicable to the person to arrive at the taxable capital gain. For example a single individual with 172925 of interest income and no deductions will pay 3274850 of federal income tax in 2019 while married couples with the same level of interest income will pay only 2439250.

Consider whether capital gains can be distributed to beneficiaries who may be in a lower tax bracket. Although irrevocable trusts are complex trusts which means they can accumulate income they make on trust assets the trustees normally reduce taxes by distributing all the trust income each year. The table below indicates capital gains rates for 2019.

It continues to be important. More than one year. The income of the trust estate is therefore 300 100 interest income 200 capital gain and the net income of the trust is 200 100 interest income.

The new tax rates for year 2019 announced There is slight increase in the Estate Tax Exclusion amount in this year. A trustee derived the following amounts in the 201415 income year. The inclusion rates for the 2018 and 2019 years of assessment are set out in the table below.

For trusts in 2022 there are three. Trust capital gains tax rate 2019 tuesday march 29 2022 edit. Important note estates and trusts pay income tax too.

10 of income over 0. Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios. At basically 13000 in income they hit the highest tax rate.

2019 Tax Bracket for Estate. The following are the income thresholds for 15 and 20 rates. Qualified dividends and capital gains on assets held for more than 12 months are taxed at a lower rate called the long-term capital gains rate.

They would apply to the tax return filed in 2022. Tax Basics for Startups. In other words if you are falling in 28 tax bracket short term capital gains in your hand will be will be taxed 28.

This gap in income tax treatment has widened considerably under the TCJA. At just 13050 in taxable income trust tax rates are 37 plus the 38 tax imposed with the Affordable Care Act. So a decedent dying between Jan.

Irrevocable trusts have a major tax issue. Income over 12500 is taxed at a rate of 37 percent while capital gains and qualified dividends over 12700 are taxed at a rate of only 20 percent. Trusts and estates pay capital gains taxes at a rate of 15 for gains between 2600 and 13150 and 20 on capital gains above 1315000.

In 2020 to 2021 a trust has capital gains of 12000 and. The trust deed defines income to include capital gains. The 2019 estimated tax.

The top marginal rate remains 40 percentThe tax rate. Taxpayers with income below the 15 rate threshold below pay 0. Included in these updates are adjustments to the 2019 tax brackets for estate and trust taxable income.

31 2019 may be subject to an estate tax with an applicable lifetime estate duty exclusion amount of 11400000 increased from 11180000 in 2018. Guidance about the tax-free allowance and telling HMRC about capital gains made by a trust has been updated. Ordinary income tax rates up to 37.

265 24 of income over 2650. For instance in 2020 trusts reach the highest tax bracket of 37 federally at taxable income of only 12950. FICA Rates-Wage Base-SE Tax.

6 April 2019 Rates allowances and duties have been updated for the tax year 2019 to 2020. It continues to be important to obtain date of death values to support the step up in basis which will reduce the. Ad From Fisher Investments 40 years managing money and helping thousands of families.

2019. One year or less. Taxpayer Bill of Rights.

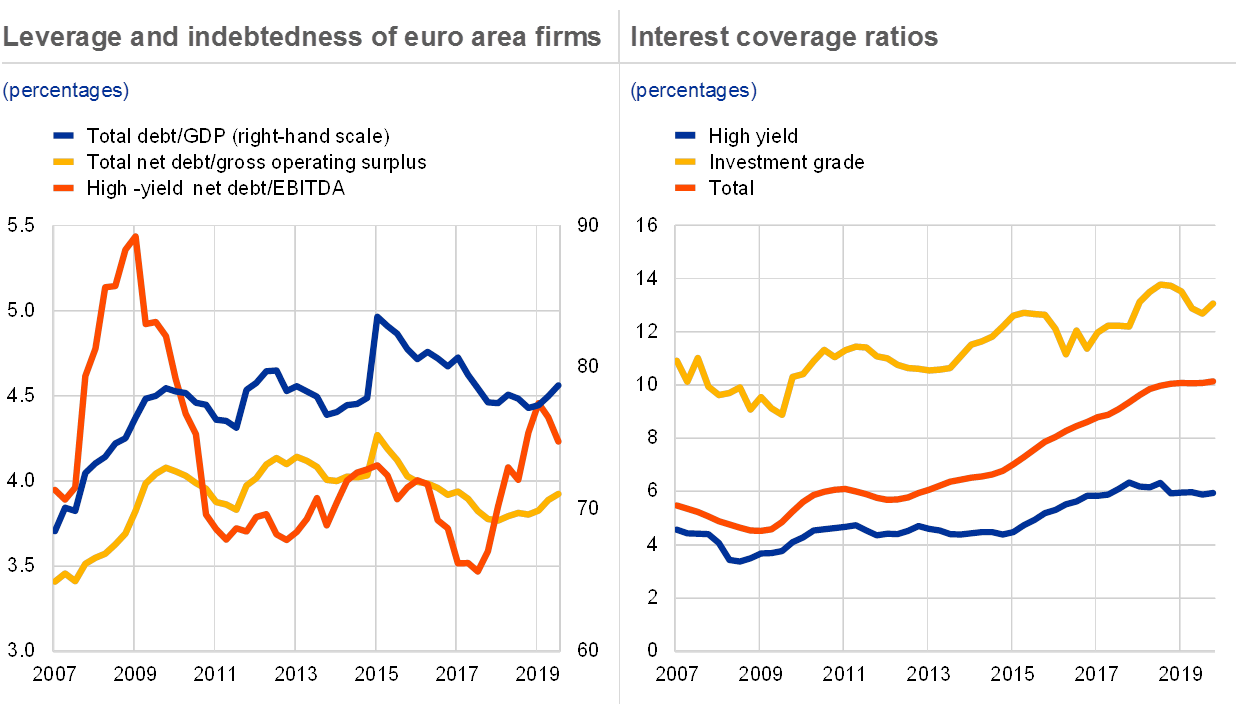

The maximum tax rate for long-term capital gains and qualified dividends is 20. Unlike other tax rates long term capital gains tax rates were not much affected by the The Tax Cuts and Jobs ActHeres a three years -Tax Year 2019 Year. Trusts pay the highest capital gains tax rate when taxable income exceeds 13150 compared to 441450 for a single individual.

2022 Long-Term Capital Gains Trust Tax Rates. 2022 Long-Term Capital Gains Trust Tax Rates. Special trust includes trusts for the benefit.

Income tax is not only paid by individuals. A capital gain of 200 that is eligible for the CGT 50 discount. Long Term Capital Gains Rate- 201920182017.

A trust is permitted to deduct up to 3000 of net capital losses in a tax year. As the tables below for the 2019 and 2020 tax years show your overall taxable income. The biggest difference between the two sets of tax brackets is that income tax has a much higher top tax rate than the top tax rate for capital gains and dividends.

For tax year 2019 the 20 rate applies to amounts above 12950.

Figure Pay Qualities With Our Free Pay Charge Instrument That Will Pull In Salaried Stars Of Government And Private D Income Tax Return Income Tax Filing Taxes

Do You Understand The 1099 Misc Ageras Irs Tax Forms Irs Taxes Tax Tricks

Taxtips Ca Ontario 2018 2019 Income Tax Rates

How To Reduce Or Avoid Capital Gains Tax On Property Or Investments Capital Gains Tax Capital Gain Real Estate Investing Rental Property

International Taxation And Luxembourg S Economy In Imf Working Papers Volume 2020 Issue 264 2020

Car Insurance For A Paid Off Vehicle The Zebra Car Insurance Compare Car Insurance Insurance Quotes

Capital Gains Tax Commentary Gov Uk

Mutual Funds Capital Gains Taxation Rules Fy 2018 19 Ay 2019 20 Capital Gains Tax Rates Chart For Nris Mutuals Funds Capital Gain Fund

Reit Investments Tax Implications In India Real Estate Investment Trust Investing Reit

What Landlords Need To Know About Schedule E Form Landlord Studio Tax Deductions Being A Landlord Property Tax

Eligibility To Claim Rebate Under Section 87a Fy 2019 20 Ay 2020 21 Illustrations Business Tax Deductions Small Business Tax Deductions Tax Deductions

Nsdl Star Performer Award 2019 Financial Services Financial Accounting

Turbotax Free Online 2019 Turbotax 2020 Canada Turbotax Guaranteed Income Tax Software

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Happy New Financial Year Startsaving Stayinvested Financial Goals Financial Year End Happy New

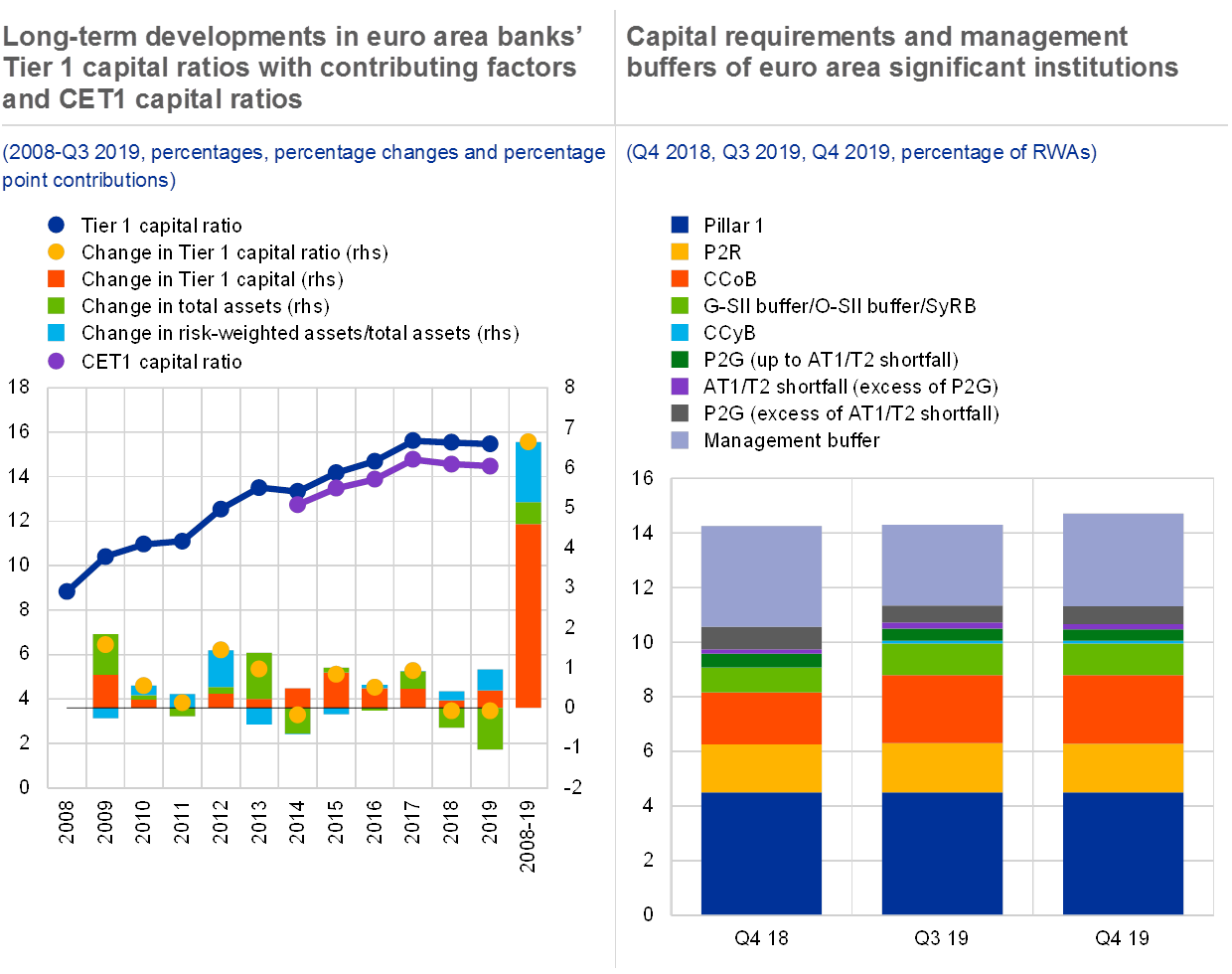

Financial Stability Review May 2020